Target of approximately €1.5bn of additional net banking income by 2024 generated in 5 priority growth areas:

- Increase in customer equipment rates, notably in non-life insurance and consumer credit,

- Close collaboration between the CIB and the retail banking networks for the development of the intermediate-sized enterprises (ISEs) market segment,

- Key expertise of the BP, CE, and CIB to address the Environmental Transition and Health sectors.

Growth in the customer base of all the business lines

OPERATIONAL EFFICIENCY PROGRAM

Groupe BPCE is aiming to achieve cost savings worth approximately €800m2 per year3:

- For Global Financial Services: optimization of IT and processes, optimization of organizational structures, real estate strategy, purchasing,

- For Retail Banking & Insurance: rationalization and IT performance, banking services, optimization and mutualization (real estate, purchasing, etc.).

Aggregate non-recurring transformation costs4 in 2021-2024 stand at approximately €900m.

For all the business lines as a whole, the Group anticipates a positive jaws effect with a target cost/income ratio of less than 65% in 2024.

CAPITAL ADEQUACY MAINTAINED AT A HIGH LEVEL

- Groupe BPCE is aiming to achieve a CET1 ratio of 15.5%4 against 15.3% at Dec. 31, 2020 (pro forma to account for the plan to simplify and develop the Group’s business lines). This target includes organic growth (excluding cooperative share inflows) estimated at ≥100bp,

- Conservative RWA growth assumptions, i.e. average annual growth rate of approximately 3% during the life of the plan, with support for business growth in a low-rate environment

- It is anticipaded that the TLAC/subordinated MREL ratio will reach a level higher than 23.5% (with a Tier 2 target of ≥ 2.5%6, a level of senior non-preferred debt of ≥ 5.5% and a management buffer of 200bp against the planned SRB requirement of 21.5% as of 2022).

2024 OBJECTIVES

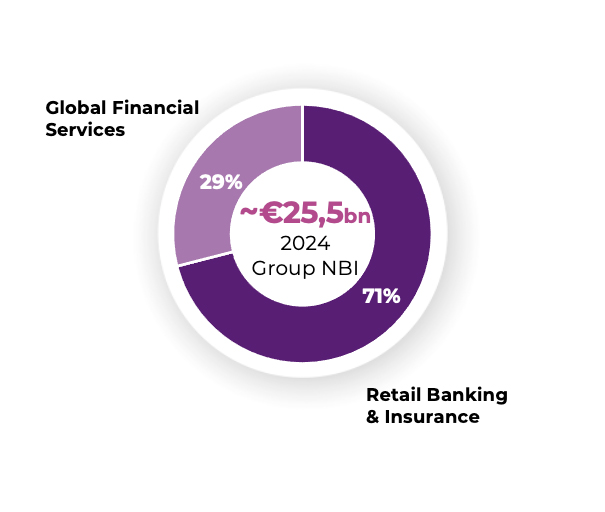

Net banking income: ~€25,5bn

Cost/income ratio: <65%

Cost of risk: <25 basis points in 2024

Net income (Group share): >€5bn

CET1: >15.5%

Tier2 target: ≥2.5%

TLAC/subordinated MREL: >23.5%

2 Including the transformation and operational efficiency plan announced by Natixis in Q3-2020

3 On a full-year basis as of 2024

4 Investments generating cost savings only

5 As a % of Groupe BPCE’s risk weighted assets (RWA)